Legal Entity Identifier India Limited (CIN- U74900MH2015PLC268921) – A Wholly Owned Subsidiary of The Clearing Corporation of India Ltd. acts as a Local Operating Unit (LOU) for issuing globally compatible Legal Entity Identifiers (LEIs) in India.

“LEIL has been recognized by the Reserve Bank of India as an “Issuer” of Legal Entity Identifiers under the Payment and Settlement Systems Act 2007 (as amended in 2015).”

LEIL has been Accredited by the Global Legal Entity Identifier Foundation (GLEIF) as a Local Operation Unit (LOU) for issuance and management of LEI's.

Why is a Legal Entity Identifier required for my organization?

The Legal Entity Identifier (LEI) is a global reference number that uniquely identifies every legal entity or structure that is party to a financial transaction, in any jurisdiction.

LEIL will assign LEIs to any legal identity including but not limited to all intermediary institutions, banks, mutual funds, partnership companies, trusts, holdings, special purpose vehicles, asset management companies and all other institutions being parties to financial transactions.

LEI will be assigned on application from the legal entity and after due validation of data. For the organization, LEI will

- Serve as a proof of identity for a financial entity

- Help to abide by regulatory requirements

- Facilitate transaction reporting to Trade Repositories

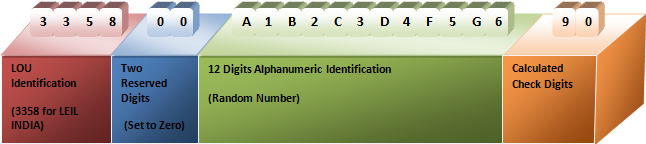

What is the LEI code?

The structure of the global LEI is determined in detail by ISO Standard 17442 and takes into account Financial Stability Board (FSB) stipulations.

LEIL as an LOU

LEIL as an LOU

The parent Company CCIL, offers a host of services that enables trading on sophisticated Trading Platforms, reporting trades to a comprehensive Trade Repository, settle the trades on a guaranteed basis through its CCP services and enjoy a range of post-trade services. At every stage, the LEI will be a useful value-addition. LEIL uses its parent company’s expertise in trading, reporting and settlement engines to bring to you LEI web portal that provides a number of benefits:

- Self-registration – Set yourself up quickly and simply

- Advanced search and filter including foreign LEIs – helps you find the information you need quickly

- Challenges – assists with the proactive maintenance of entity data

- Easy to use interface – User Guide, FAQs and very little training required

- Accuracy and reliability – Rigorous duplicate check from consolidated database from other LOUs.

What's New

LEIL announces the reduction of fees for New Registration and Renewal effectively from July 1, 2024 Read more

LEIL has appointed MNS Credit Management Group Private Limited (https://www.mnscredit.com/) , a B2B debt management and business information company, as Validation Agent. MNS Credit partners with LEIL to carry out validation process while issuing /renewing LEI's to Indian entities.

Please click here to read them

LEIL has appointed Rubix Data Sciences Private Limited (https://rubixds.com/) , a technology driven analytics-based company , as its first Validation Agent . Rubix partners with LEIL to carry out validation process while issuing /renewing LEIs to Indian entities.

We are happy to inform that LEIL has developed an API facility for LEI search and is available to test in mock environment.

Read more

Please click here to know the Renewal Process